Submitted by World Revolution on

This is an extract from a text prepared for a recent internal meeting of the ICC’s section in Britain.

A range of official data allows us to see that the working class’ working and living conditions are under sustained attack.

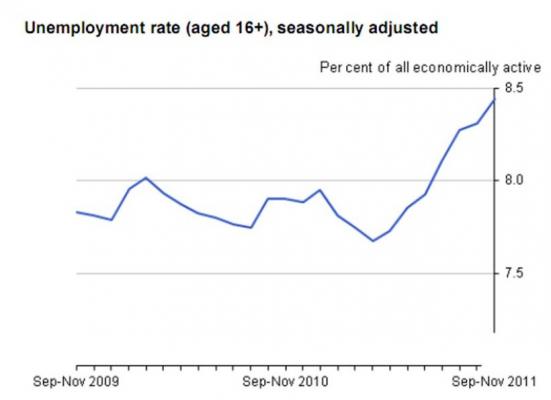

• Unemployment has continued to increase, reaching 8.4%, in the three months to November 2011, an increase of 0.3% over the preceding three months and of 0.5% compared to the same time a year ago. This amounts to 2.68 million people in total and to an increase of 118,000 compared to the previous quarter and of 189,000 compared to a year earlier. Of this total, 857,000 had been unemployed for over 12 months (a drop of 10,000 compared to the previous quarter but a rise of 25,000 compared to a year earlier) and 424,000 for over 24 months (up 1,000 on the previous quarter). Amongst 16 to 24 year olds the unemployment rate is 22.3%. Excluding young people in education (who are counted if they have been looking for work in the preceding 4 weeks), the total was 729,000, an increase of 8,000 over the previous quarter, making the rate of unemployment amongst young people not in education 20.7%.[1] Public sector employment fell by 67,000 in the third quarter of 2011.[2]

• The rate of redundancies has picked up over the last few months after falling back between November 2009 and November 2010. In the three months to November 2011 164,000 had become redundant (either voluntarily or enforced), an increase of 14,000 over the preceding quarter and of 5,000 compared to a year ago. The overall rate was 6.6 workers per thousand.[3]

• Growth in pay has slowed over the last few months falling to 1.9% in the three months to November 2011 from 2.8% in the previous quarter. The ONS offers an explanation: “This marked drop in earnings growth may reflect a number of pressures in the labour market: the desire by firms to reduce their costs in the face of weak demand; weak wage bargaining power of employees as a result of high unemployment and low employment levels; falling inflation that ease the decline in real wage growth and so reduce the pressure on employers to maintain wage growth; and falling demand and output.”[4] The same report goes on to note that the rate of increase in the public sector in the three months to November was 1.4% compared to 2.0% in the private sector, “This demonstrates the impact of the sustained public sector pay freeze. Both public sector and private sector wage growth are well below CPI inflation and so the sustained decline of real wages has continued.”[5] However, it is worth noting that overall cuts in pay were made much more rapidly in the private sector than the public sector – research by the IFS concluded that “it will take the whole of the two-year public pay freeze and two years of 1% pay increases to return public pay to where it was relative to private sector pay in 2008. This is because private sector pay reacted quickly to the recession. Pay in the public sector did not.”[6] This merely reflects the fact that the economic laws of capitalism take effect more rapidly in the private than the state sector.

• The average number of hours worked per week stood at 31.5 in the three months to November 2011, which is unchanged from the previous quarter. However, the total number of hours worked per week fell by 0.2 million to 916.3 million.[7]

• Labour productivity increased by 1.2% over the quarter to November 2011 while unit labour costs rose by 0.5%. However, this should be put in the context of falls in productivity compared to most major competitors during 2010.[8]

• The total amount of personal debt declined between December 2010 and 2011, falling from £1.454 trillion to £1.451 trillion. The majority of this borrowing is for mortgages, which increased from £1.238 trillion to £1.245 trillion. In contrast consumer credit fell from £216bn to £207bn. This suggests that workers are reducing spending or have less access to credit. Nonetheless, the average amount by owed adults in the UK stood at £29,547 in December 2011. This is about 122% of average earnings. The total owed is still more than the annual production of the country.[9]

• The impact of debt continues with 101 properties being repossessed every day in the last three months of 2011 and 331 people becoming insolvent. However, both figures have fallen since the previous quarter but in contrast it seems there has been a significant growth in the numbers using informal insolvency solutions while nearly a million “are struggling but have not sought help.”[10]

• Older people have seen the value of their pensions eroded by effective rates of inflation that are above the official figures with a third reporting they can only afford the basics, a quarter saying they buy less food, 14% reporting going to bed early to keep warm and 13% saying they only live in one room to cut down on costs.[11]

These figures show the efforts that workers are going to in order to get by: cutting down on spending in order the keep their homes; accepting reductions in pay in order to keep jobs, albeit with limited success. The lower than anticipated rate of repossessions and insolvencies and the apparent willingness of financial bodies to agree informal arrangements to manage debt suggest that the bourgeoisie is also trying to mitigate the impact of the crisis. This makes sense both economically (managing debt means it is more likely to be repaid) and politically. How long this can be maintained is uncertain given that the cuts are only in their first stage:

• “By the end of 2011–12, 73% of the planned tax increases will have been implemented. The spending cuts, however, are largely still to come – only 12% of the planned total cuts to public service spending, and just 6% of the cuts in current public service spending, will have been implemented by the end of this financial year. The impact of the remaining cuts to the services provided is difficult to predict; they are of a scale that has not been delivered in the UK since at least the Second World War. On the other hand, these cuts come after the largest sustained period of increases in public service spending since the Second World War. If implemented, the planned cuts would, by 2016/17, take public service spending back to its 2004/05 real-terms level and to its 2000/01 level as a proportion of national income.”[12]

• “The planned cuts to spending on public services are large by historical standards… If the current plans are delivered, spending on public services will (in real terms) be cut for seven years in a row. The UK has never previously cut this measure of spending for more than two years in a row… if delivered, the government’s plans would be the tightest seven-year period for spending on public services since the Second World War: over the seven years from April 2010 to March 2017, there would be a cumulative real-terms cut of 16.2%, which is considerably greater than the previous largest cut (8.7%), which was achieved over the period from April 1975 to March 1982.”[13] The report by the IFS goes on to note that no country has ever cut spending at the level proposed for the number of years proposed.[14] It should be noted that all of these predictions are based on the assumption that the economy will pick up in the years ahead.

• People retiring in the year ahead expect to have an annual income of £15,500, which is 6% less than those who retired in 2011, and 16% less than those who retired in 2008. One fifth expect an annual income of £10,000 while 18% of those retiring expect to do so with debts averaging £38,200. The ending of final salary pension schemes in the private and public sectors (this is likely to be the reality of any deal stitched by the unions and bosses to resolve the current confrontation) will see far more workers living in poverty in their old age.[15]

• Levels of child poverty are predicted to return almost to the level seen in the late 1990s when the Labour government began efforts to reduce it. By 2020/21 4.2m children are forecast to be living in poverty, compared to 4.4m in 1998/9.[16]

• “The Office for Budget Responsibility’s November 2011 forecast for general Government Employment estimates a total reduction of around 710,000 staff between Q1 2011 and Q1 2017.”[17] North 08/02/12

[1]. ONS “Labour Market Statistics” January 2012

[2]. Credit Action, “Debt statistics”, February 2012.

[3]. ONS “Labour Market Statistics” January 2012

[4]. Ibid.

[5]. Ibid

[6]. Institute for Fiscal Studies, Press Release 31/01/12: “Latest public pensions reforms unlikely to save money over longer term; four year pay squeeze returns public/private differential to pre-recession level”.

[7]. ONS “Labour Market Statistics” January 2012

[8]. ONS “International comparisons of productivity – First estimates for 2010”. Interestingly, this report states that between 1991 and 2004 the UK experienced the fastest growth rates of all G7 countries.

[9]. Credit Action, “Debt statistics”, February 2012.

[10]. Ibid.

[11]. Ibid, citing research by Age UK.

[12]. Institute for Fiscal Studies, “Green Budget 2012”

[13]. IFS Op Cit, p.68

[14]. IFS Op Cit, p.72: “On the internationally comparable measure, UK public service spending is set to fall by 11.3% over the five years from 2012–13 to 2016–17. This is large compared with the size of cuts to public spending experienced by other industrialised countries over the last forty years… None of these countries has, for the periods for which we have data, cut this measure of public service spending for five consecutive years. In two instances, cuts have run for four years in a row: in the United States from 1970 to 1973 (cumulative cut of 4.0%) and more recently in Canada from 1994 to 1997 (cumulative cut of 3.9%).”

[15]. Credit Action, “Debt statistics”, February 2012.

[16]. End Child Poverty, “Child Poverty Map”, January 2012.

[17]. Credit Action, “Debt statistics”, February 2012

del.icio.us

del.icio.us Digg

Digg Newskicks

Newskicks Ping This!

Ping This! Favorite on Technorati

Favorite on Technorati Blinklist

Blinklist Furl

Furl Mister Wong

Mister Wong Mixx

Mixx Newsvine

Newsvine StumbleUpon

StumbleUpon Viadeo

Viadeo Icerocket

Icerocket Yahoo

Yahoo identi.ca

identi.ca Google+

Google+ Reddit

Reddit SlashDot

SlashDot Twitter

Twitter Box

Box Diigo

Diigo Facebook

Facebook Google

Google LinkedIn

LinkedIn MySpace

MySpace